child tax credit december 2019 payment date

Find COVID-19 Vaccine Locations With. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022.

Input Tax Credit Tax Credits Business Rules Reverse

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

. The federal body says in order to stop advance child tax credit payments you must unenroll three days before the first Thursday of the following month by 1159 pm. Check mailed to a foreign address. Wait 5 working days from the payment date to contact us.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. Learn more about the Advance Child Tax Credit.

If your payment is late check the. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Have been a US.

Max refund is guaranteed and 100 accurate. 31 2021 so a 5-year. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. The IRS bases your childs eligibility on their age on Dec. December 13 2022 Havent received your payment.

This means that the total advance payment amount will be made in one December payment. At first glance the steps to request a payment trace can look daunting. Claim the full Child Tax Credit on the 2021 tax return.

15 opt out by Aug. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

You dont have to unenroll. October 5 2022 Havent received your payment. 15 opt out by.

This includes families who. Goods and services tax harmonized sales tax GSTHST credit. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

Youll need to print. Includes related provincial and territorial programs. 13 opt out by Aug.

3 January - England and Northern Ireland only. The couple would then receive the 3300. Easy Fast Secure.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one. Unlike in previous years half of each credit is being paid out in monthly installments from the IRS that started in July and will run through December.

December 26 2019 Actual pay date. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Those payments will last through December.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Lets condense all that information. December 25 2019 Actual pay date.

Benefit payment dates in England for Christmas and New Year 2019-2020 Tax credits. 21 rows 28 December - England and Scotland only. MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline.

The remaining 1800 will be. January 1 2020 Actual pay date. Families will receive the entire 2021 Child Tax Credit that they are.

Child benefit is usually paid every four weeks on a Monday. Complete IRS Tax Forms Online or Print Government Tax Documents. Child tax credit payments in 2022 will revert to the original amount prior.

Free means free and IRS e-file is included. The child tax credit is usually worth 2000 per qualifying child but for 2021 its been expanded to 3600 for kids ages 5 and under and 3000 for kids between 6 and 17. The full credit is available for heads of households earning up to 112500 a year.

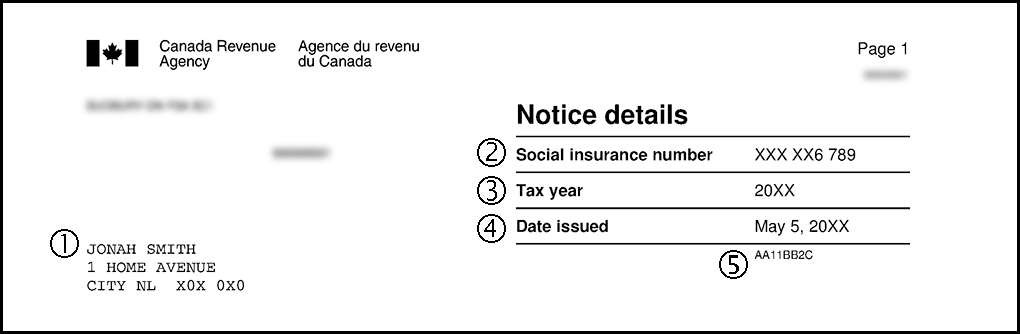

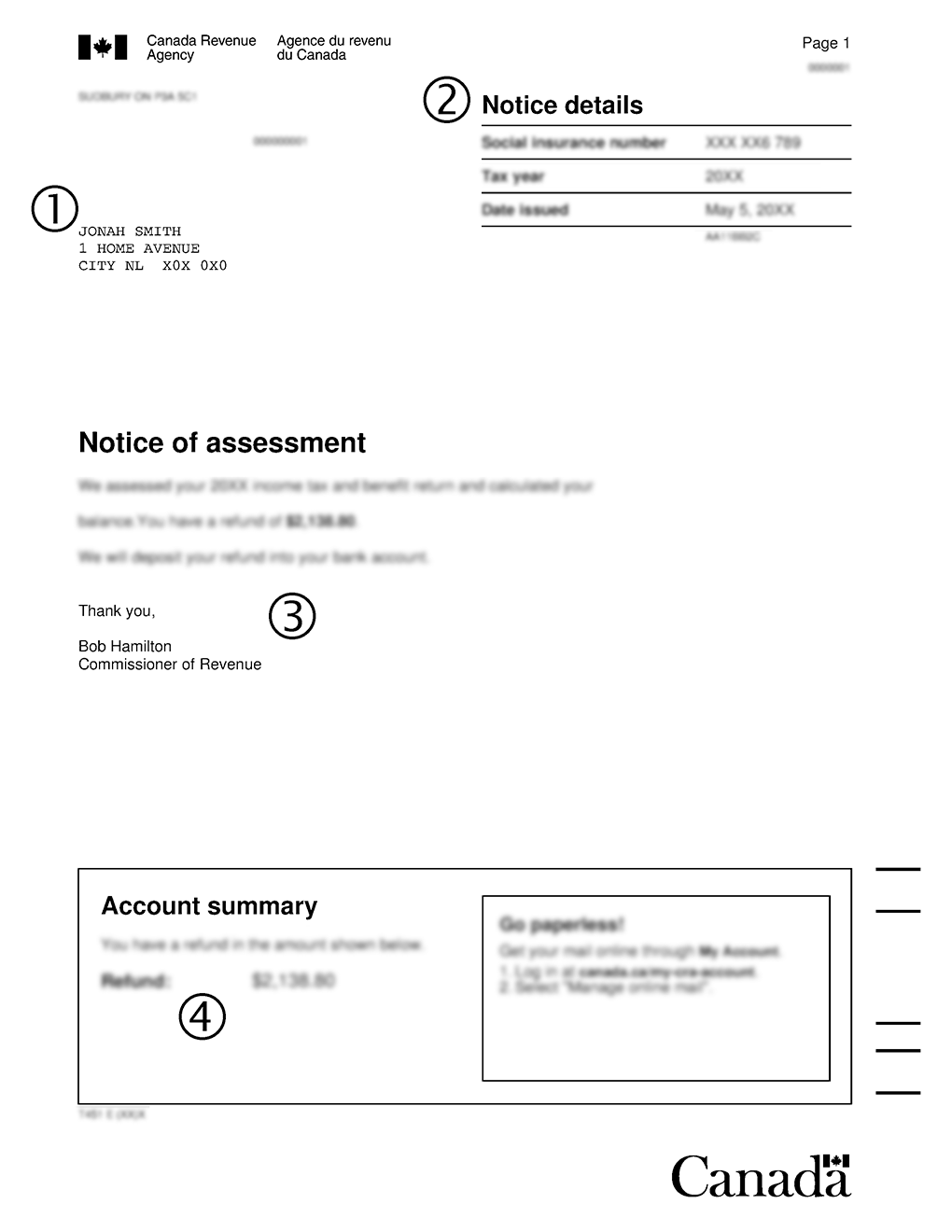

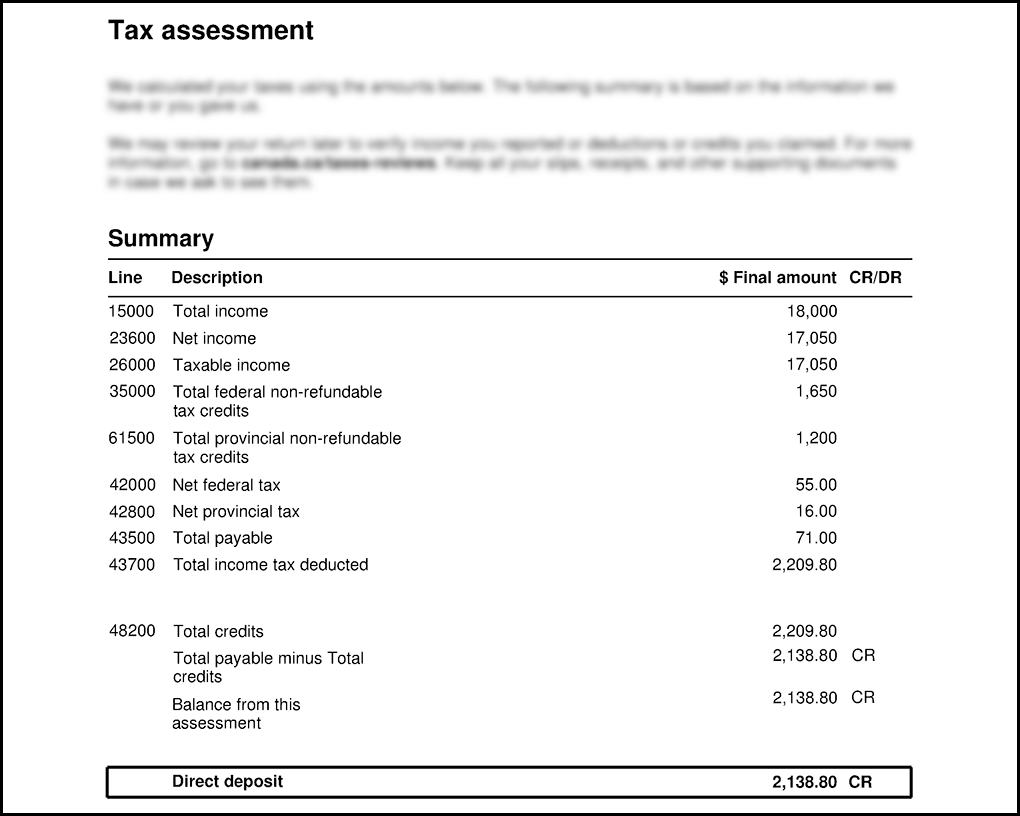

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Make Your Enrollment Process Easier Today

Types Of Gst Returns And Due Dates Accoxi

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

B2b Businesses Are Exempted From Using Rupay Bhim Upi For Accepting Payments Business Taxact Finance

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

Money Dates 2019 Ativa Interactive Corp Dating Personals Dating How To Plan

Canada Child Benefit Ccb Payment Dates Application 2022

Pin On Taxation And Business Software

Canadian Tax News And Covid 19 Updates Archive

Free Commercial Credit Application Form Template In Ms Word

If You Are Still Struggling With Gst Return Mismatches Then Hostbooks Gst Is Right Here To Help You Out We Billing Software Accounting Software Payroll Taxes

Canada Child Benefit Ccb Payment Dates Application 2022

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

Form 13 13a Instructions How To Get People To Like Form 13 13a Instructions Unbelievable Facts Tax Forms Irs

5 Things To Remember For Us Expats Things To Know Us Tax Infographic

Child Tax Benefit Dates 2022 When It Is Deposited Genymoney Ca